What you should consider before deciding on a single-trip or an annual travel plan?

Travelling abroad can be stressful and requires a lot of planning which is why preparation is key. As we may need to deal with unplanned mishaps, it is important with getting the right coverage in advance that suits your budget and needs. Whether you’re travelling for business trips or a frequent traveler, we can help provide a comparison of single-trip and annual travel insurance and which is better based on your travel needs.

What is a single trip insurance?

A single-trip insurance covers for a one-off destination or more of your choice and ends when you return home. As the cost covers for a return trip, this policy tends to be more affordable than annual coverage. You can tailor the length of days you are away and places you visit with your coverage.

What is an annual travel insurance?

The annual travel insurance covers for multiple countries based on your plan for 365 days from the effective date of the policy. The plan covers medical expenses, trip cancellation, trip interruption and even emergency medical evacuation and repatriation. In this case, it is considered more convenient as you only need to purchase one policy to cover multiple trips in a year whether it is the furthest country selected in your listed coverage.

Is it worth it to have annual travel insurance than a single-trip cover?

The value of getting annual travel insurance depends on a few factors including:

1. The number of trips you travel within a year

2. The countries you will be visiting are covered in your travel plan

3. The type of medical and travel protection coverage needed for your trip(s)

What are the benefits of getting annual travel insurance?

Value for money – it may work out to be cheaper per trip if you are taking three or more trips in a year within the same region compared to a single trip.

Convenience – if you have multiple trips covered under a single plan, there is less hassle to constantly apply for every trip.

Coverage in multiple countries – trips to multiple countries included in your region may stack up in medical and travel expenses which makes annual travel insurance more cost-effective. This option also eliminates the need to purchase a new policy for each trip.

Spontaneity in booking – if you unplanned multiple trips, you can board a flight at short notice with ease while being covered by the annual travel plan.

Frequent traveler – annual travel insurance may be the best option for frequent travelers as it provides coverage for multiple trips in different regions all year.

Are there limits to getting covered for annual travel?

Entry of age – the range of entry is usually between 18-60 years with an additional cost for for each traveler above the maximum limit or with a pre-existing medical condition.

Travel for short trips – unless you plan to travel abroad at least 40 or more days, getting an annual travel insurance would serve more value to your budget needs for multiple single trips.

Coverage limits – consider the coverage limits that your chosen policy covers all the destinations you plan to visit. For example, ensure that your policy provides adequate coverage if you have high-value items such as expensive jewelry or digital cameras.

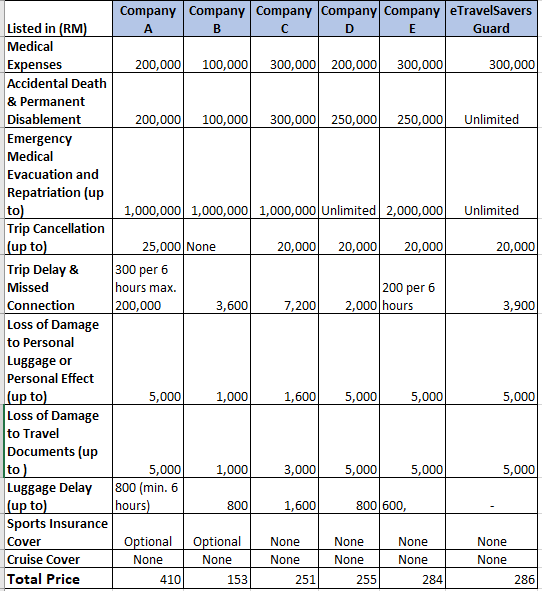

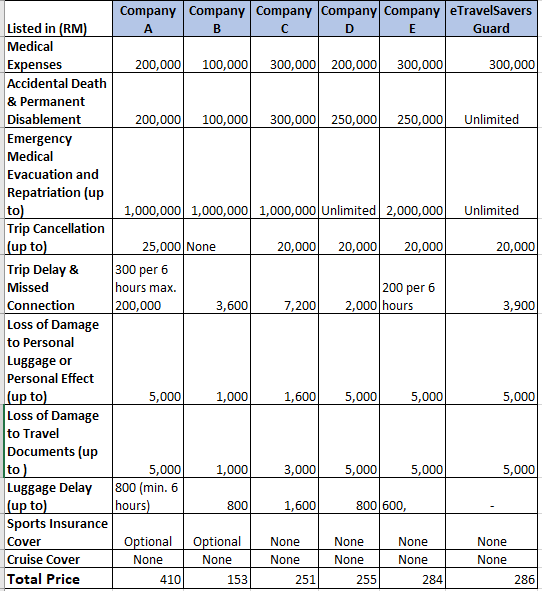

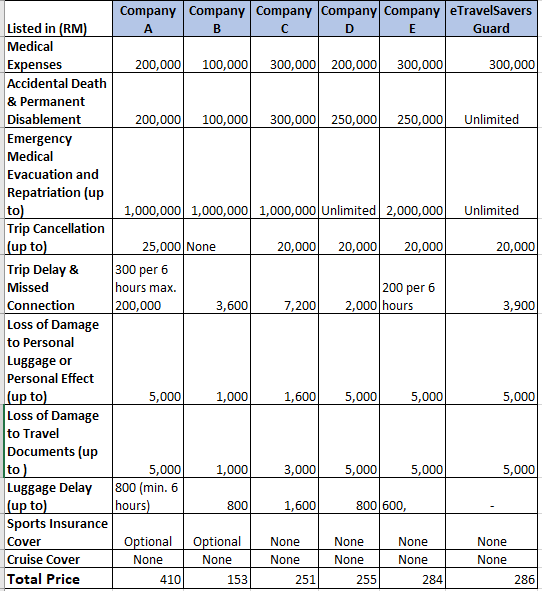

To help you find out the most suitable annual travel plan, let’s take a look below at how the competitor in the market ranks against eTravelSavers Guard:

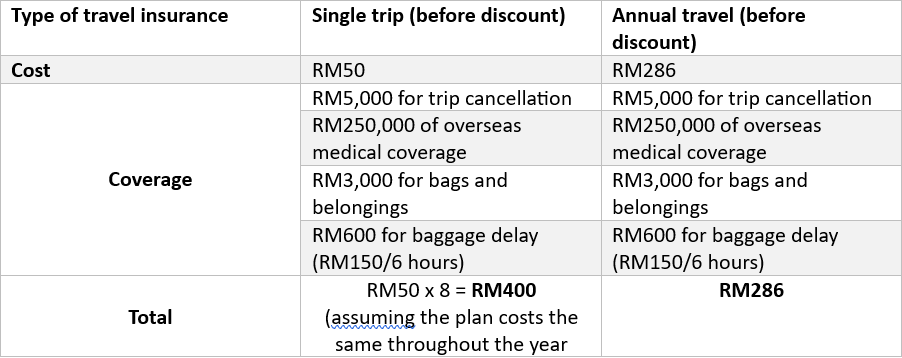

If you will be travelling around Asia at least 8 times this year, with a trip duration of 5 days each time. Annual travel insurance is the better option for those who fly in and out of Malaysia more than 6 times a year.

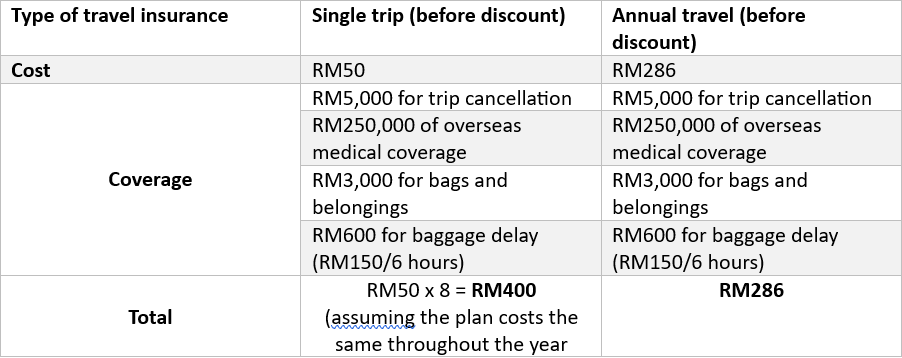

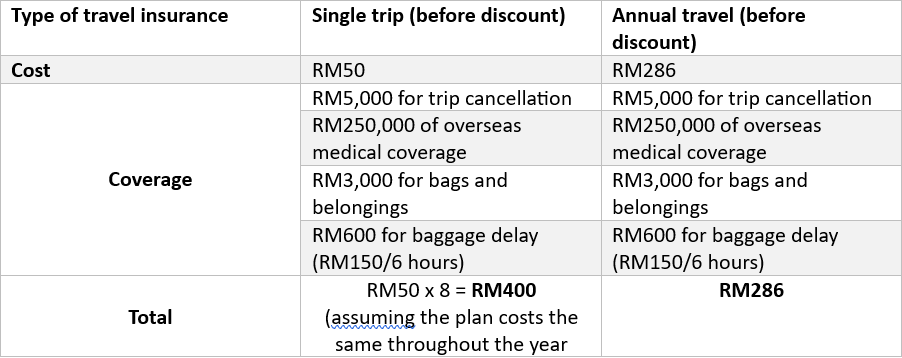

As shown in the example below, a single trip travel insurance plan cost RM50 while an annual plan costs RM289. In this case, travelling more than five times to the same region with annual travel insurance is more cost-effective. However, the frequency to determine whether an annual plan is worth it differs for each provider and plan, depending on the premium.

Why does eTravelSavers Guard offer the best value protection for travelling?

With an annual policy, you don’t need to worry about cover when you book a holiday every time. If you’re a frequent traveler, AIG Malaysia offers an annual travel plan eTravelSavers Guard that offers the best travel and medical coverage and value on keeping you protected on your travel needs.

The annual plan includes trip cancellation coverage for all trips costs up to RM2500, up to RM500 in missed connections coverage, up to RM1500 in trip delay connection, accidental death and dismemberment up to RM50,000 and additional protections. These limitations are instituted per trip, while you pay an annual premium to cover all excursions.

If you’re still undecided, eTravelSavers Guard provides a quality insurance plan with up to RM1,000,000 in medical emergency evacuation expenses. For example, this annual travel policy includes cancellation for work-related reasons and natural disasters out of your control. By ensuring you have comprehensive protection for unexpected hazards on your journey, getting eTravelSavers Guard will include all the standard protections in the market and additional coverage for a wider range of circumstances.

What else should I consider?

The benefit of having annual travel insurance is you can plan a trip at short notice or mitigate the loss from the sudden cancellation of a side trip that allows to modify an existing annual policy to include additional trip costs under certain circumstances.

When comparing annual and single trip travel insurance, be sure to check exactly what is and isn’t covered, and consider the following:

- Do you want travel insurance just yourself or would you like for family or group?

- What countries are you visiting?

- Do you need add-ons like winter sports travel insurance or extreme sports cover?

- Do you have any pre-existing medical conditions? These can make annual cover expensive.

Meanwhile, you should also consider how spontaneous your travel plans tend to be. If you don’t have multiple trips planned and you’re the type to jet off for a weekend at short notice, you should factor that into deciding your travel plan coverage.

With an annual travel insurance plan, frequent travelers like you can plan their trips with ease. It saves the hassle of applying for each trip and enjoy year-round coverage on trip cancellations, baggage loss, theft, accidents and more!